Table of Contents

Google’s November core update is here

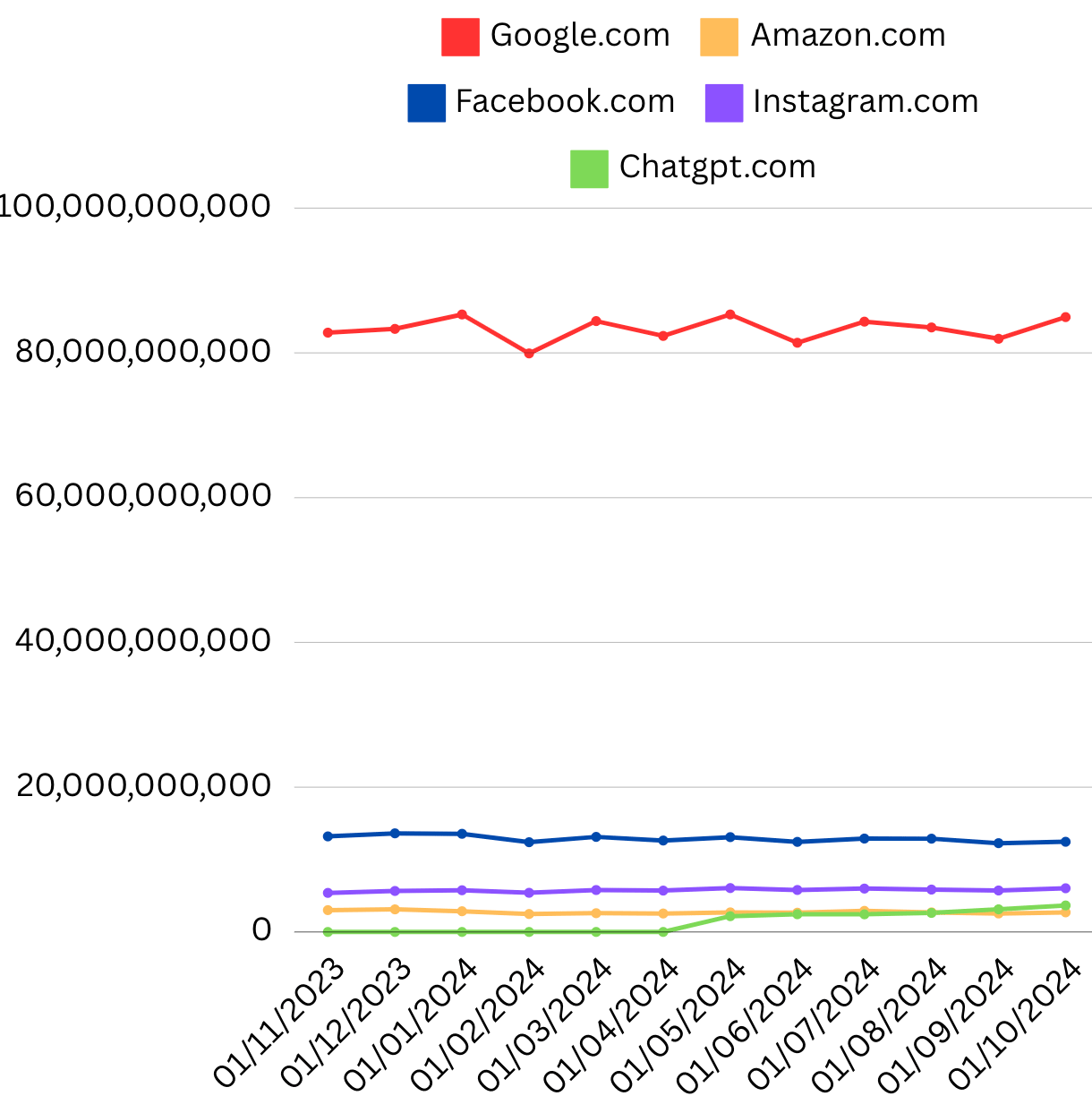

Over the past two years, there has been a lot of attention shifting towards the sexy newcomer ChatGPT at the expense of the search behemoth that is Google. We forget that Google.com easily commands the most amount of visits globally out of the major tech players:

(Of course, Google is set up on ccTLDs - so .co.uk, .fr and .de- along with Amazon, so this only paints part of the picture)

This week the search giant released its November 2024 Core Update, which can have a seismic shift in rankings and a website’s search visibility. So far (16/11), we haven’t seen too much movement from the verticals that I am analysing (that can change very quickly!) but here are some tips from my experience in working in search and the impact of core updates.

Manage expectations - It is essential to ensure that you communicate to key stakeholders a) what is happening b) why this is happening and c) what the potential upside / risks are from this. I always send out a pack with FAQs explaining the impact to the CEO, CFO and CCO, along with other key stakeholders across marketing and product.

Understanding core updates - These are updates that you can’t respond with a knee jerk reaction and make changes to counter a drop in visibility. Core updates take into account months of assessing a domain and you should let the update play out rather than making lots of changes.

Set a plan - If you’ve stagnated or declined in visibility, it is essential to define a plan of action. This plan should include:

Audit: Assessing all pages on your domain to determine how helpful they are to a user. You can use crawling software such as Lumar or Screaming Frog and then work with your content team on a ‘keep, combine, kill’ methodology. If you have a huge website, this can be very time consuming, but it is honestly worth it as it improves the customer experience (better, more relevant content), which in turn will improve visibility in search.

Tech fixes: Ensure there aren’t significant amounts of broken links, 404 pages or URLs being generated that you are unaware of (i.e. via search parameters). This can contribute towards bringing your overall website performance down and this is one of the key factors that often gets overlooked - Google assesses your website as a whole, rather than just in isolation on a single page. You really need to throw the kitchen sink at SEO to ensure that your website can be the best that it can.

Product sync: You must work in hand in hand with product and in this particular case with UX (User Experience) to ensure that customers are a) finding your content useful and b) can easily navigate to discover content. There is no point in burying a killer piece of content three levels deep, so you need to ensure users can discover your website through a well-structured information architecture and navigation.

Use tooling to monitor performance - This really is an always on approach, but becomes even more important to understand the landscape, following a core update announcement.

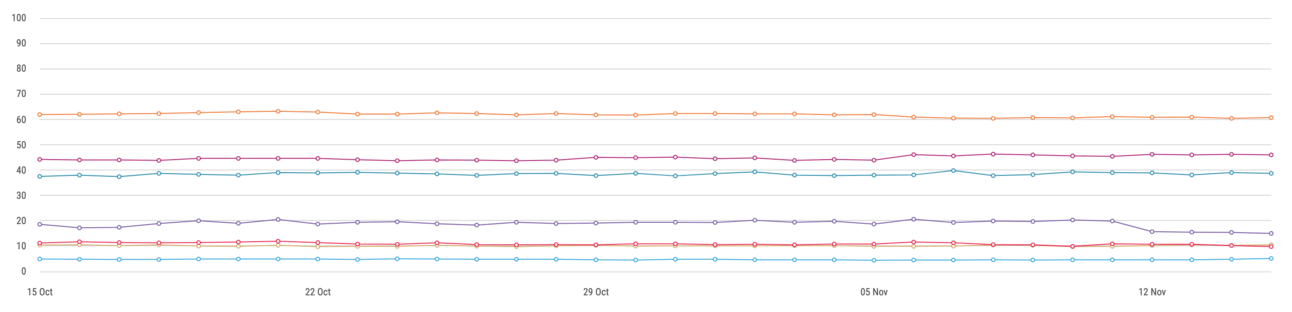

Google Search Console is essential in understanding the impact to your website from a clicks perspective, whereas if you use other tools such as Pi-datametrics or Similarweb, you can see how it has impacted competitors. You can see an example of a domain within the fintech space in Australia below (purple line) and a drop in visibility since November 11th:

Anonymised chart from Pi-datametrics showing a drop in visibility for a domain within the fintech space, the day after Google announced the roll out of the update. So far, this is the only significant movement I have seen.

Use your expertise or lean on colleagues/friends: Assessing a core update through the lens of a startup versus a decades old corporate can be very different, so take this into account when planning and executing your strategy.

To use a startup example, when I was at Cazoo, the company began trading in December 2019. There were three core updates the following year, one in January, one in May and the last one in December. Although I would never chase algorithms as my approach is a customer centric one, I knew it could have a huge impact on visibility.

January came far too soon and we hadn’t even launched on TV by then. May was also too soon and I wasn’t that pleased with the progress we’d made regarding the enhancements required via the product team. By the following December, a full seven months later, I was pretty happy with the progress we’d made regarding the execution of the strategy and we never looked back following the core update on December 3rd, which saw Cazoo shoot up in terms of visibility. As they say, the rest is history.

You can listen in more detail about this on my podcast interview with Ben Goodey.

It is easy to say “don’t panic” because if it doesn’t go your way and you’re in an unforgiving environment, the pressure can be unbearable. I would ensure that you work in a place with a decent and supportive boss (honestly, life is too short to work for arseholes) and surround yourself with positive but realistic colleagues and support network. People you can turn to for advice or to bounce ideas around with.

If you’re in need of organic performance (SEO) support, then feel free to drop me an email below.

Black Friday is nearly here

Tis the season to be looking for cheap shit online is fully upon us. But is it starting earlier and how prepared do you have to be? Here are three key insights

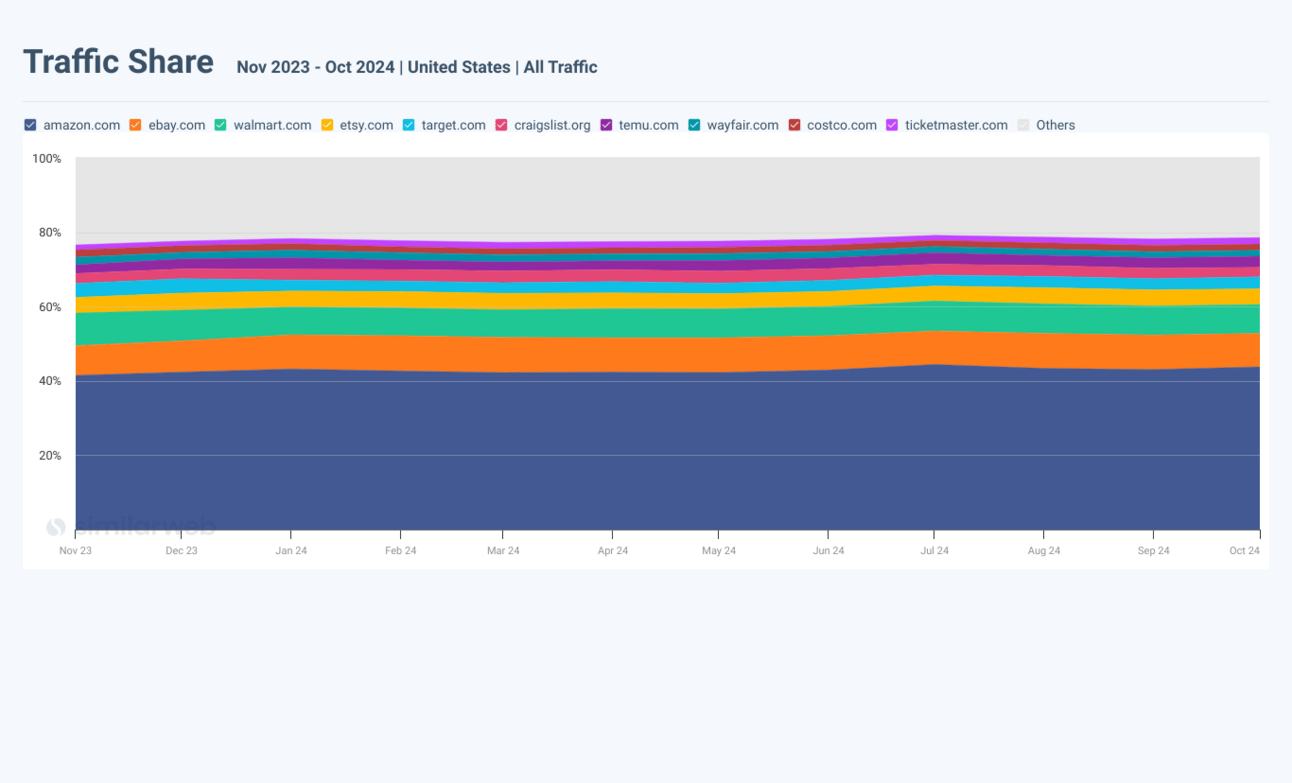

In the US, Amazon is still the market leader in terms of traffic share within the e-commerce category (not specific to ‘Black Friday’) with ebay coming in second. Note that despite the huge interest in Temu’s rise and significant advertising spending over the past 24-months, the fast-fashion firm is still way off the Seattle giant despite entering the top ten in late 2022.

The Chinese startup’s heavy advertising can’t match Amazon’s 20-year lead, vast logistics network, and trusted brand. Amazon’s refined marketing and diverse offerings keep it firmly ahead.

Screenshot from Similarweb showing the traffic share of major e-commerce players in the US over the past 12 months.

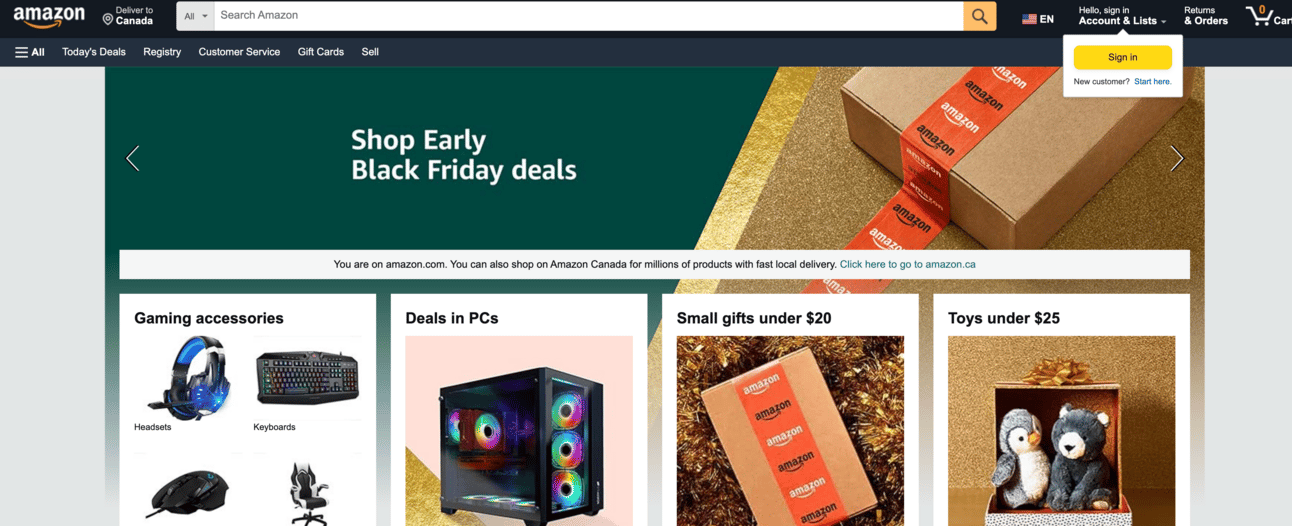

Last November, Amazon began pushing the Black Friday deals early in November:

Screenshot of Amazon.com from November 10th 2023 pushing the Black Friday comms message. Non-personalised experience.

But this year, Amazon has focused more so on the generic “shop for the holidays” messaging. Perhaps given Amazon’s dominance and brand strength, they can promote deals as opposed to the event itself:

Screenshot of Amazon.com from November 16th 2024 without a single mention of “Black Friday” on the homepage. Non-personalised experience.

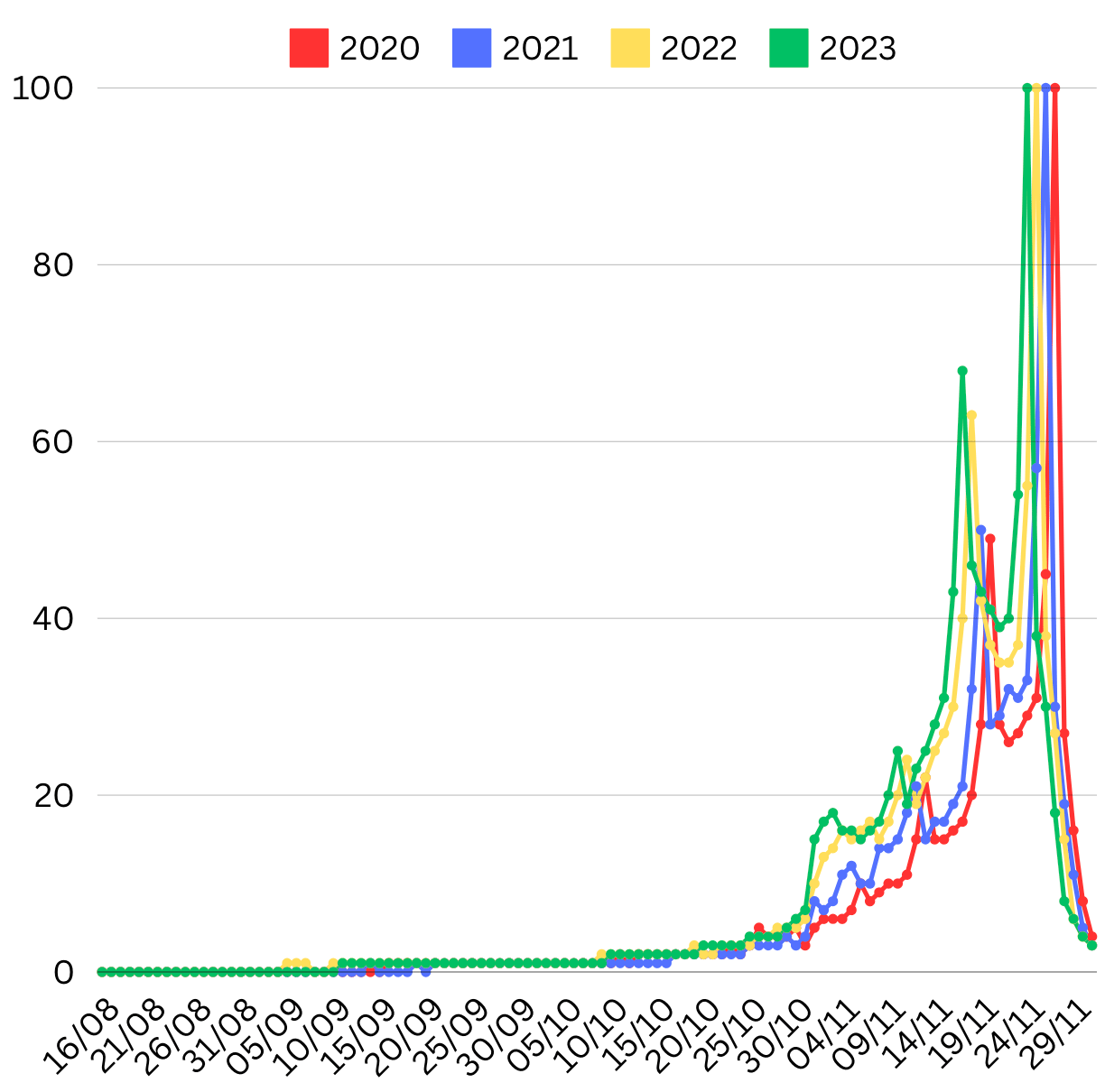

Users turn to search to seek out information about deals earlier and more intense every year (note: the Black Friday date also shifts!). The below chart is from Google Trends, which shows global search interest building in late October and more intensely:

Data taken from Google Trends from 2020 to 2023 for the query term “Black Friday”.

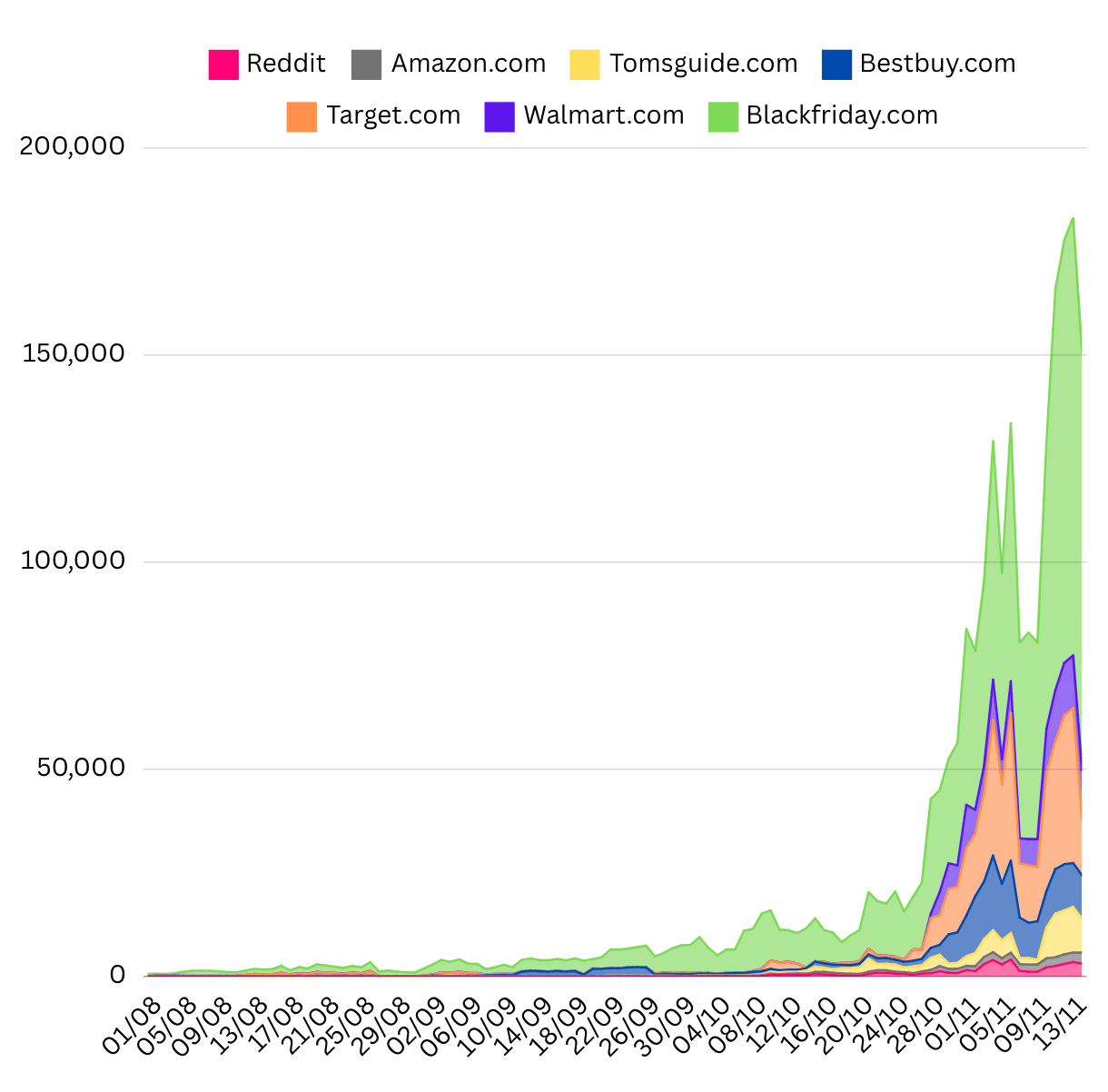

Looking at a specific keyword query group (i.e. “black friday”, “black friday 2024” and “black friday deals”) within organic search for the category, Amazon has really dropped off from 2023, whilst Blackfriday.com continues its dominance for the event:

Data taken from Similarweb using the feature ‘SERP players’ against the keyword group ‘Black Friday’.

Amazon is still bidding heavily in paid search across the category, so perhaps has shifted their strategy to paid acquisition over organic discoverability as there isn’t a single mention of the event on the homepage.

In the news this week

Here is a quick recap of some of the stories I read this week:

Perplexity will start offering ads: The AI-powered search engine will begin experimenting with ads as it looks to build an additional revenue stream. Perplexity is looking to take advantage of their growing user base, which according to Similarweb nearly doubled in October 2024 (90.48m) vs. that of May 2024 (48.75m). The rival to Google and chatGPT took a thinly veiled swipe at one of its competitors by stating:

“We will avoid duplicating the SEO industry where people are implementing arbitrary tactics to improve their rankings at the expense of user utility”

Their recent blog post states they have onboarded Indeed, Whole Foods Market, Universal McCann, PMG and others as advertising partners.

Shift to performance marketing in 2025: Ebiquty and the WFA ran a survey that shows 42% of advertisers plan to increase their share of performance marketing in 2025, while only 24% intend to increase their share of branding. These numbers have switched from 2024, with respondents suggesting they would spend 21% and 35% (more) respectively. This has been driven by retail media and connected TV. This shift highlights the need for instant short-term results at the expense of longer-term brand building.

The report has some big players, with 134 global brand leaders, including 7 of the world’s top ten global advertisers, which collectively represent over $66bn in annual ad spend. Confidence is especially high in Europe, Middle East and Africa, whilst the US is taking a more cautious approach tied to economic and political factors.

Klarna announces it has filed for a 2025 IPO: Klarna, the ‘buy now pay later’ Swedish-based firm, has announced that it has filed to go public sometime in 2025, choosing New York over London. Klarna serves approximately 85 million consumers worldwide, with a notable presence in the United States, where it has over 37 million users.

2025 could be a blockbuster year for IPOs, with Shein, Reliance Jio and Revolut all rumoured to be going public.

Klarna's CEO, Sebastian Siemiatkowski, has been vocal about the transformative impact of artificial intelligence (AI) on the company's marketing operations, which now operates at half the size, with AI cited as a major driver of enabling this. The fintech firm cited a 25% decrease in agency spend and a $6million saving on stock photography.

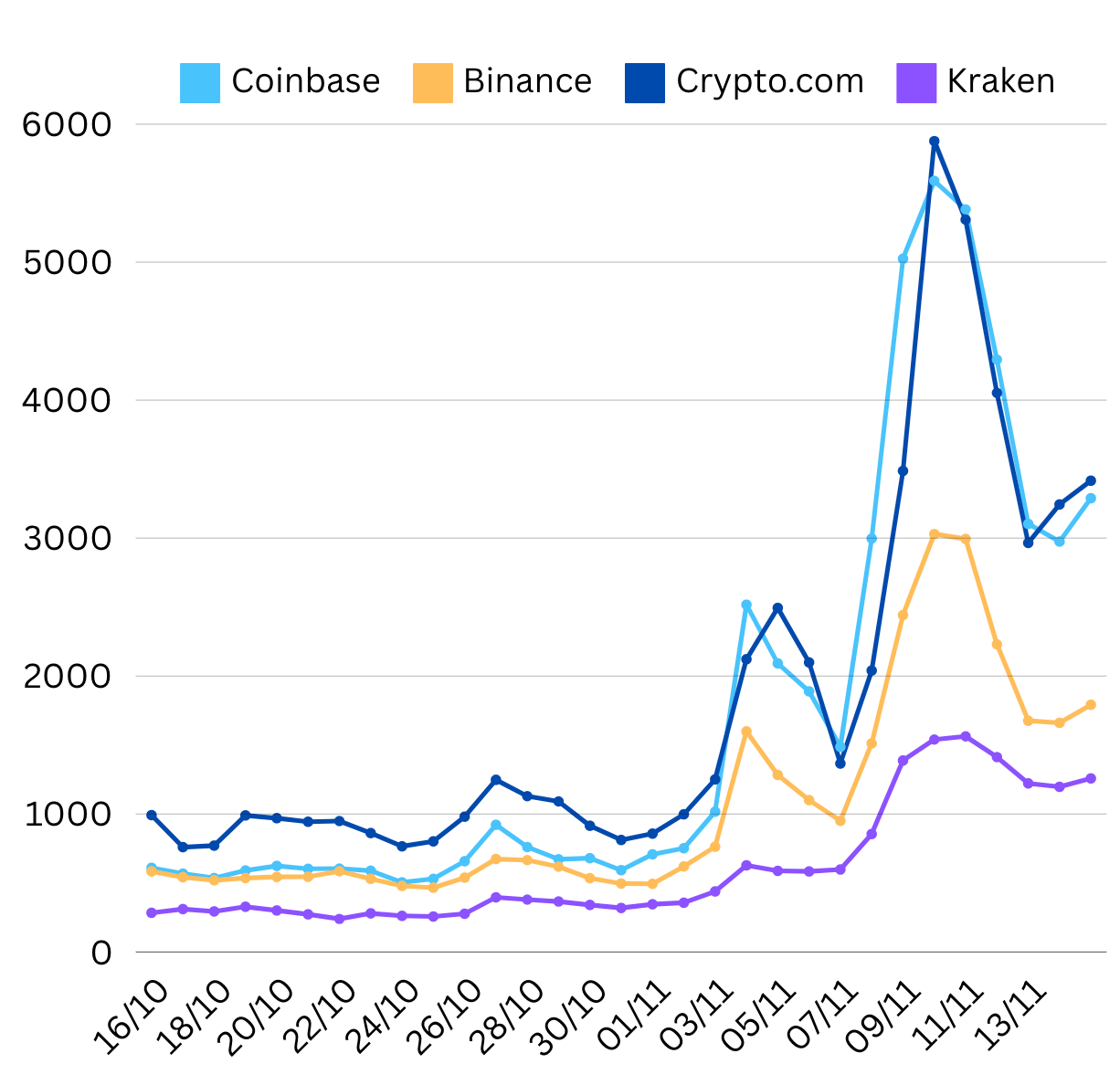

Bitcoin continues to surge: The price of Bitcoin went up 38% over the past month following Donald Trump’s victory in the 2024 US election following his “pro-business” and “pro-crypto” stance.

Looking at data from the UK app store (iOS), AppTweak’s download estimates show a bump in downloads following the US election to some of the best known brands:

Estimated downloads from AppTweak within Apple’s App Store over the past month for big Crypto exchanges.

This will be a mix of both brand (e.g. “coinbase”) and generic (e.g. “buy bitcoin”) searches through organic and Apple Search Ads that will be driving performance and leading to downloads. This is only one region (UK), but I suspect the picture will be very similar in other regions as users look to ride the Bitcoin wave.